Understanding Direct Pay and Transferability for Tax Credits in the Inflation Reduction Act - Center for American Progress

Table 1 from Iowa's Earned Income Tax Credit Tax Credits Program Evaluation Study | Semantic Scholar

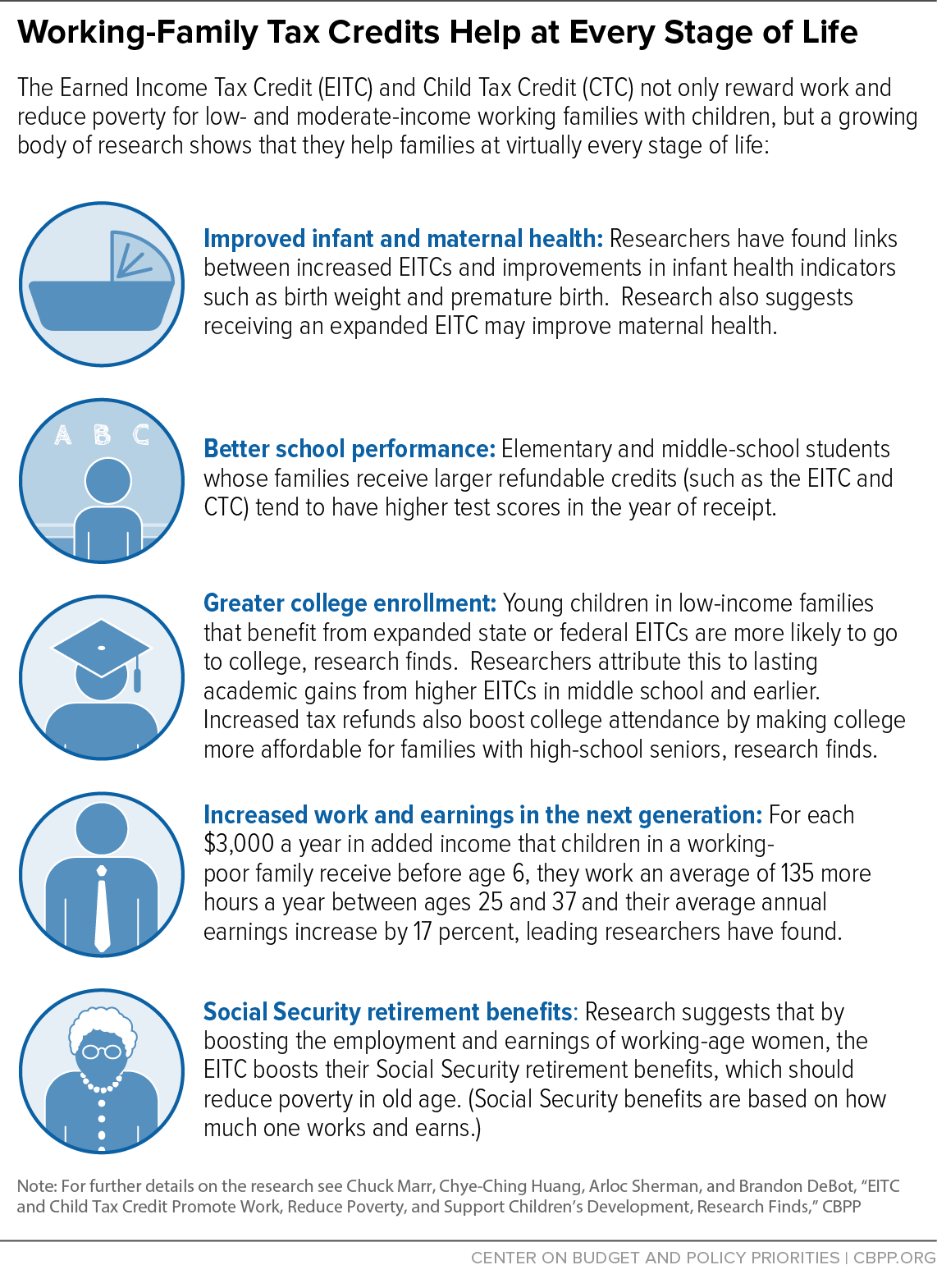

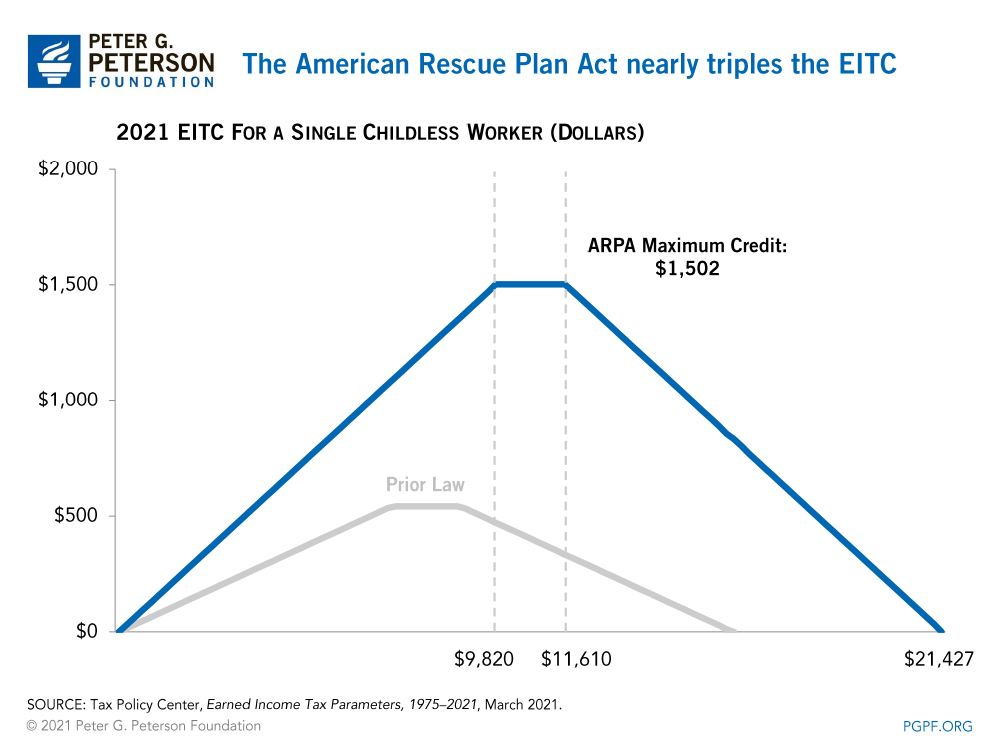

Chart Book: The Earned Income Tax Credit and Child Tax Credit | Center on Budget and Policy Priorities

:max_bytes(150000):strip_icc()/2022TaxTableExample-a04b9e0f21ae4f0080ae5017bba3cb7f.png)